Selling, General, and Administrative SG&A Expense Ratio

The budget is typically presented in either a monthly or quarterly format. It may also be split up into segments for a separate sales and marketing budget and a separate administration budget. Both selling expenses and administrative expense may be fixed or variable (see cost behaviour).

What is the Difference Between SG&A vs. Operating Expense?

The SG&A expense ratio is crucial for businesses because it helps them monitor their operating costs and track their profitability. A high ratio could indicate that a company is spending too much on overhead costs, which could ultimately impact their bottom line. Therefore, it’s essential to maintain a healthy SG&A expense ratio to ensure that the business is operating efficiently and effectively.

Some non-operating expenses

These expenses are then deducted from the gross margin to arrive at operating profit. However, not all expenses have been recorded when calculating operating profit. Some expenses such as interest or tax expenses are reported below operating income. A company might choose to aggregate or segregate marketing and advertising costs, often depending on the size of the company and the level or frequency of these expenses. SG&A expenses are incurred regardless of the level of sales or production incurred during a certain period.

- Employees who are not properly trained on expense tracking and management may make mistakes or miss opportunities to save money.

- How management decides to group and analyze its expenses implicitly defines how they view and understand the company.

- Stanford University resources (i.e., booking channels or payment methods) may be used to book, purchase, or reimburse expenses for the Stanford portion of the travel.

- However, some companies may report selling expenses as a separate line item, in which case the SG&A is changed to G&A.

- Additionally, implementing a system for tracking and analyzing spending can help identify areas where costs can be reduced or optimized, leading to greater efficiency and effectiveness in SG&A spending.

- Items like lease payments on a business’s facilities or bank loan payments are typically fixed because they don’t change month to month.

What is the difference between selling and operating expenses?

They include the costs of shipping and shipping supplies, delivery charges, and the payment of sales commissions. SG&A includes almost every business expense that isn’t included in the cost of goods sold (COGS). COGS includes the expenses that are necessary to manufacture a product, including the labor, materials, and overhead expenses. SG&A costs are the other expenses that are necessary to run the organization.

This content is not a substitute for obtaining legal advice from a qualified attorney licensed in your jurisdiction and you should not act or refrain from acting based on this content. This content may be changed without notice, and it is not guaranteed to be complete, correct or up to date, and it may not reflect the most current legal developments. Do not send any confidential information to Cooley, as we do not have any duty to keep it confidential. This content may be considered Attorney Advertising and is subject to our legal notices. The views expressed on the blog do not constitute legal advice, and are the views of the authors only and not those of Cooley. The distinction found in the financials will be based on the relative size of each, which depends on the specific industry in question.

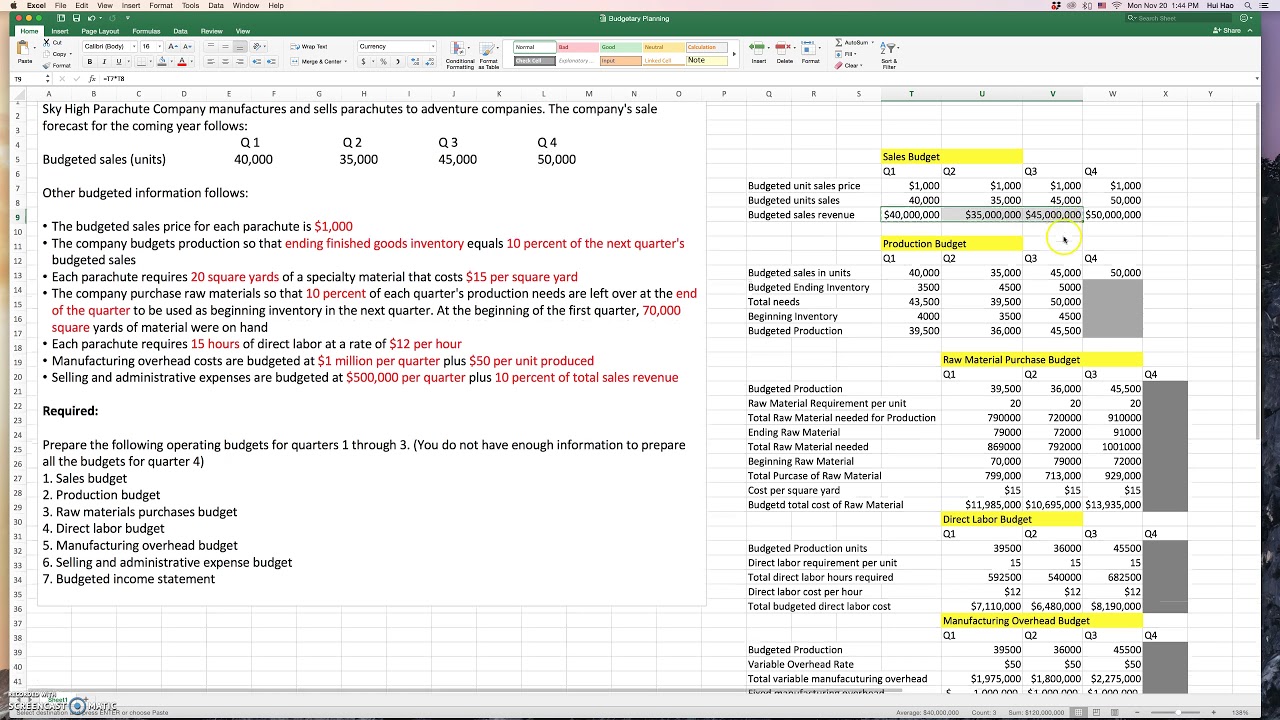

Simply put, selling and administrative expenses are all the expenses not directly related to the production of a product. That includes the budgets of all non-manufacturing departments such as marketing, accounting, sales, engineering, and so on. Operating expenses and selling, general, and administrative expenses (SG&A) are two types of costs that companies incur. Both relate to the day-to-day costs of running a business that are not directly tied to the production of goods and services. An administrative budget is essentially all planned selling, general and administrative (SGA) expenses for a period of time.

Once SG&A is deducted from gross profit – assuming there are no other operating expenses – operating income (EBIT) remains. The SG&A expense is recorded on the income statement of companies in the section below the gross profit line item. Calculating SG&A expenses is straightforward when expenses have been classified into the correct accounting categories. Reporting and accounting software should be able to pull out these expenses and correctly assign them to the SG&A category. However, there are several factors to keep in mind when calculating SG&A costs. As a result, these are also one of the first places managers look to slash costs when they’re reducing redundancies after mergers or acquisitions.

This includes personnel expenses and also everyday operating expenses such as insurance, supplies, travel and entertainment, rent, and payroll taxes. Selling and administrative expenses even include non-cash expenses such as depreciation and amortization. One of the areas where management has the most control, and therefore a key consideration of managerial accounting, is a company’s selling and administrative expenses.

An administrative budget enables management to exercise control of the day-to-day activities of the business. Indirect selling expenses include advertising and marketing costs, the company’s selling and administrative expense budget telephone bills and travel costs, and the salaries of its sales personnel. Such expenses occur throughout the manufacturing process and even after the product is finished.

Deja una respuesta