SG&A: Selling, General, and Administrative Expenses

If you’re trying to get a better handle on your business finances, Bench can help. This means that 26.65% of every dollar XYZ Inc. earns gets spent on SG&A expenses. Learn more about Bench, our mission, and the dedicated team behind your financial success. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease.

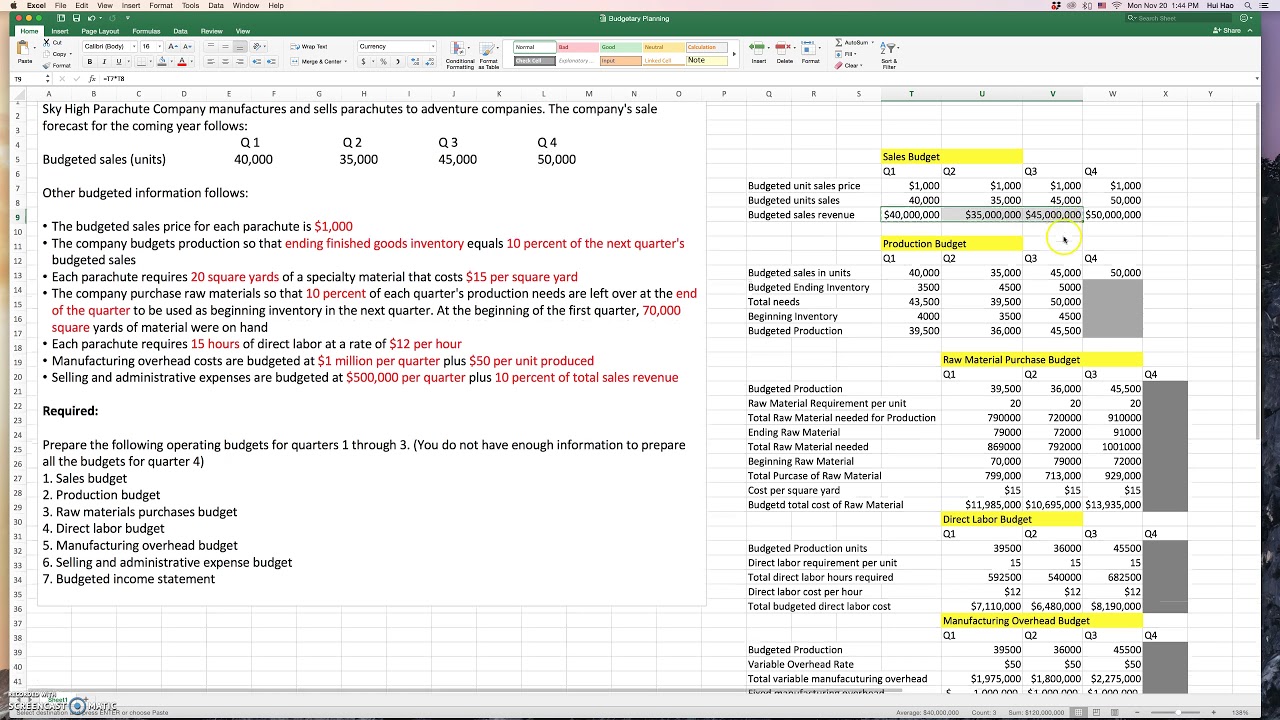

Forecasting Fixed and Variable Expenses

SG&A can be calculated for any period such as for a month, a quarter, or a year. Be mindful that nominal accounts, such as expenses, are closed at the end of the accounting year. This information is often readily available in historical financial reports. It is not customary to include a cash requirements calculation as part of this budget.

Why You Can Trust Finance Strategists

- While industry standards provide a useful reference point, they do not take into account the unique circumstances and goals of each business.

- While this is typically synonymous with operating expenses, often companies list SG&A as a separate line item on the income statement below the cost of goods sold, under expenses.

- The operating budget includes all the revenue the firm expects to receive during the next fiscal year and all the expenses it expects to make.

- By streamlining processes, investing in technology that automates tasks, and outsouring activities, businesses can reduce manual labor costs and allocate resources toward more profitable activities.

By implementing cost-saving measures such as bulk purchasing and negotiating better deals with suppliers, businesses can significantly reduce their SG&A expenses and improve their profitability. It is important for businesses to regularly review their SG&A expenses and identify areas where cost-cutting measures can be implemented without compromising the quality of their operations. These expenses can be the difference between a profitable business and one that struggles to stay afloat. By monitoring the SG&A expense ratio, businesses can identify areas of inefficiency and make changes to reduce costs, which can improve their bottom line. There are several strategies that businesses can use to reduce SG&A expenses, such as automating tasks, outsourcing, and negotiating with suppliers and vendors for better pricing.

Keep closer track of your spending

There are also a few specific accounts that may warrant specific accounting treatment that excludes them from SG&A. Depreciation costs are often reported in this section of the income statement but are excluded from SG&A as well. Both encompass expenses that are necessary to operate a business independent of the costs of manufacturing goods. When you look at a completed SG&A budget, it looks simple because it may not have as many line items in it as other sections of the operating budget, if your business is involved in manufacturing. Deciding on the fixed and variable portions of your costs is not always easy but can change your forecasted net income. Managerial accounting is much more customizable than financial accounting, and therefore, it can provide many more practical tools for managers.

Common operating expenses include rent, utilities, insurance premiums, and property taxes, whereas typical SG&A expenses include legal expenses, accounting expenses, and advertising expenses. These expenditures can either be lumped together on a company’s income statement as operating expenses or broken down, in which case the amount spent specifically on SG&A will be revealed separately. Selling and administrative expenses are typically a huge line item on a company’s income statement. It includes almost every expense that the company incurs not directly related to the production of its products. Part of this process is subdividing the broad “selling and administrative” expenses into smaller, more useful subgroups.

SG&A: Selling, General, and Administrative Expenses

This makes SG&A an easy target for a management team looking to boost profits quickly. It’s also the first place that private equity firms or strategic investors perform their due diligence when they’re considering an investment or acquisition target. However, the SG&A expense must be standardized to be compared side-by-side to industry comparables, and the average benchmark varies significantly selling and administrative expense budget based on the specific industry. The SG&A ratio is simply the relationship between SG&A and revenue – i.e. the expense expressed as a percentage of total sales. For example, manufacturers range anywhere from 10% to 25% of sales, while in health care it isn’t unusual for SG&A costs to approach 50% of sales. The magic happens when our intuitive software and real, human support come together.

Costs such as interest and taxes aren’t included in SG&A because they’re deducted from operating income. Assess whether expenses are directly related to the manufacturing of the product. Costs that aren’t included in the production of goods must be included in the SG&A calculation. If a firm’s business is cyclical, forecasted budgets may have to be adjusted for variable expenses in only a few months of the year. When an outside institution or entity funds travel on that organization’s behalf and provides full payment for those travel expenses, the trip is considered externally sponsored.

Simply put, selling and administrative expenses are all expenses not directly related to the production of a product. Common expenses included in operating expenses are rent, utilities, labor, and property taxes. These are the expenses directly tied to the day-to-day operations of a business.

Deja una respuesta